ChatGPT and its potential impact on banking services

You’ve probably heard that OpenAI launched a revolutionary machine learning model trained to generate human-like text in a conversational way. The chatting bot technology ChatGPT is extremely advanced, but what does that mean for banking and its ethical implications? To answer this question, I’ve started a dialogue session with the AI model. And I’ll end with some remarks from a software engineer perspective.

ChatGPT: A new standard in human-to-computer interaction

A characteristic of highly educated individuals is being able to communicate complex ideas efficiently in text form. Developing this skill is not an easy task and requires years of formal education and a lot of practice. A particular AI software called ChatGPT, created by OpenAI and released for preview in December 2022, made writing complex answers in text form look extremely easy.

ChatGPT sets the bar high in human-to-computer interaction. The quality of the produced text and the speed of its replies can be felt immediately after the first reply. But it also provokes some mixed feelings, ranging from excitement about the possibilities, to caution when figuring out its potential implications.

How ChatGPT was trained

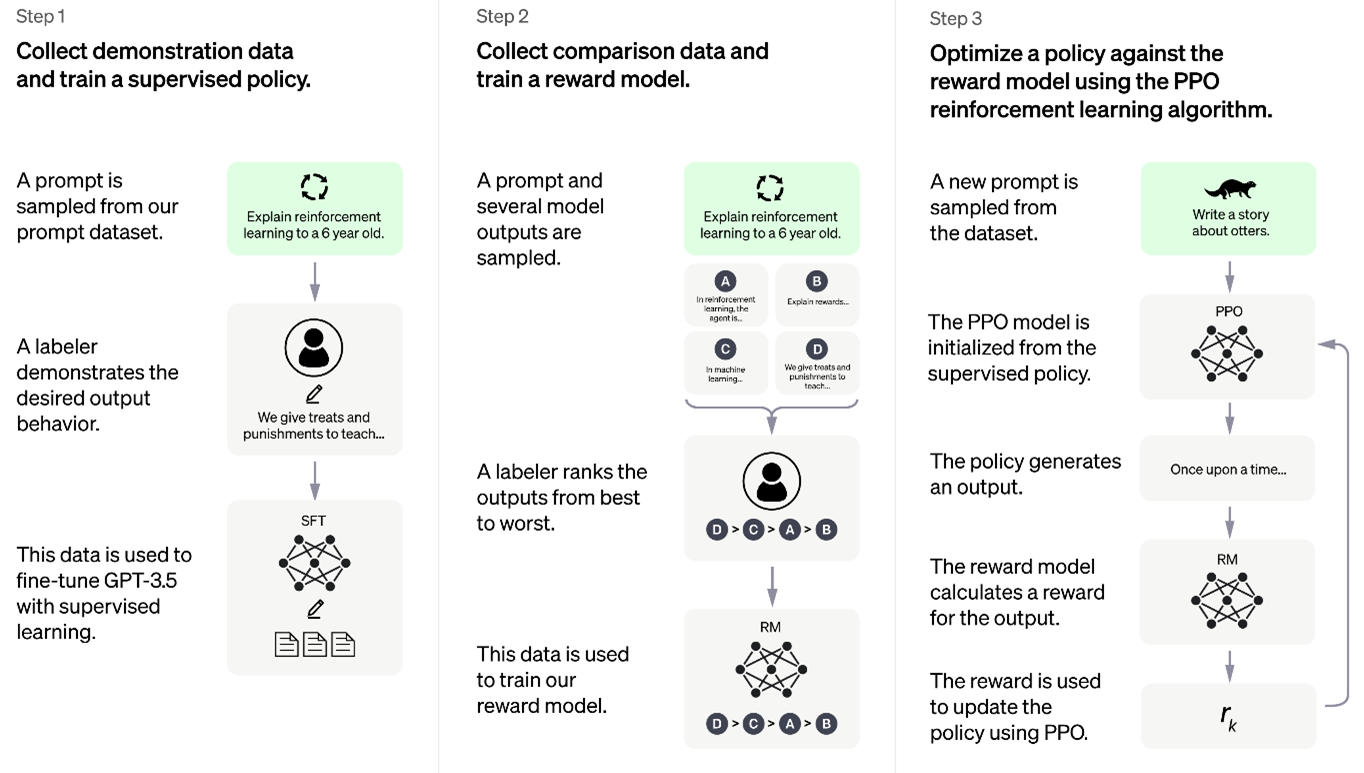

ChatGPT was trained using Reinforcement Learning from Human Feedback (RLHF), meaning that during its training analists were involved in scoring and selecting the best results in a reward / penalty mechanism.

For technical reference about Reinforcement Learning, please check OpenAI.com.

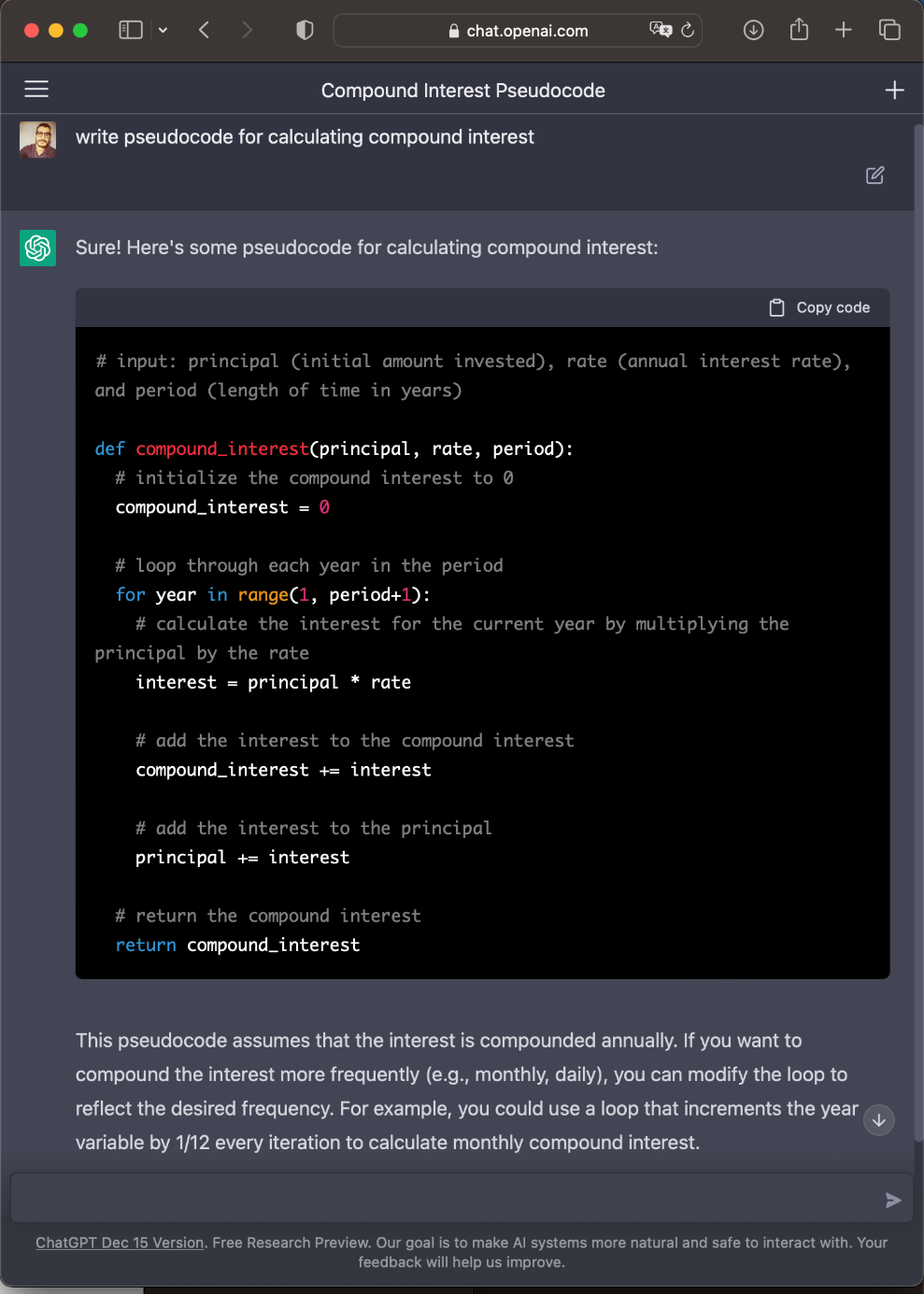

Experiment: a dialogue with the chatbot

As an experiment I started a dialog with ChatGPT, by introducing myself, supplying some context and asking a few related questions. I wanted to evaluate if it understood my inputs and could elaborate further on previous replies.

How does ChatGPT work? And how can ChatGPT impact banking?

Me: "Can you explain in a few words how you work and how your capabilities can impact banking and financial services in general?"

ChatGPT: "Certainly! As a language model, I am a machine learning model that is trained to generate human-like text based on a large dataset of human-generated text. I do this by using statistical techniques to predict the next word in a sequence based on the words that came before it.

In the context of banking and financial services, language models like me can be used to automate various tasks, such as customer service, fraud detection, and financial reporting. For example, a language model could be trained on a dataset of customer service inquiries and responses to generate personalized responses to customer inquiries in real-time. This could potentially improve efficiency and reduce the workload of customer service representatives.

Language models can also be used to analyze financial documents and extract important information, such as company names, financial metrics, and dates. This can be useful for tasks such as financial reporting, risk management, and compliance.

Overall, the use of language models in banking and financial services can help to improve efficiency, reduce workload, and increase the speed at which tasks are completed. However, it's important to carefully consider the ethical and societal implications of using language models and to ensure that they are used in a responsible and transparent manner."

Further examples on how AI is being used in banking

The quality of the contextual information related to banking and financial services and the examples given caught my attention. The model not only elaborates text but seems to have some inherent built-in knowledge about the field and its inner workings. That set the tone for my second question:

Me: "Can you give further examples how AI is being used in the banking industry?"

ChatGPT: "Yes, certainly! Here are a few examples of how AI is being used in the banking industry:

- Customer service: AI-powered chatbots and virtual assistants can be used to handle customer inquiries and provide personalized recommendations in real-time. This can improve customer satisfaction and reduce the workload of customer service representatives.

- Fraud detection: AI algorithms can be trained to identify patterns and anomalies in financial transactions that may indicate fraudulent activity. This can help banks to detect and prevent fraudulent transactions before they occur.

- Credit risk assessment: AI algorithms can be used to analyze a borrower's financial history and other relevant data in order to assess their creditworthiness and determine whether to grant them a loan.

- Personalized marketing: AI algorithms can be used to analyze customer data and create targeted marketing campaigns based on their preferences and behaviors.

- Trading: AI algorithms can be used to analyze market data and make trades on behalf of investors.

- Financial reporting: AI algorithms can be used to analyze financial documents and extract important information, such as company names, financial metrics, and dates. This can improve the speed and accuracy of financial reporting.

These are just a few examples of how AI is being used in the banking industry. It's likely that the use of AI in this sector will continue to grow and evolve in the coming years."

Co-relating answers

In my last question, I wanted to verify cause and effect relations by correlating the two previous answers:

Me: "Correlating the previous answers, what are the ethical and societal implications of each one of these examples?"

ChatGPT: "The ethical and societal implications of using AI in the banking industry depend on the specific application and how it is implemented. Here are some potential ethical and societal implications of the examples I provided:

- Customer service: Using AI-powered chatbots and virtual assistants to handle customer inquiries may improve efficiency and reduce the workload of customer service representatives. However, it may also result in the loss of jobs for some customer service employees. It's important to ensure that the use of AI in customer service is implemented in a way that is fair and transparent, and that any negative impacts on employees are minimized.

- Fraud detection: AI algorithms can be very effective at detecting fraudulent activity, but it's important to ensure that they do not have any biases that could unfairly affect certain groups of people. It's also important to ensure that false positives are minimized, as wrongly identifying a transaction as fraudulent can have serious consequences for the person involved.

- Credit risk assessment: AI algorithms used to assess creditworthiness may be based on data that is not relevant or that unfairly disadvantages certain groups of people. It's important to ensure that AI algorithms used for credit risk assessment are trained on diverse and representative data and do not perpetuate existing biases.

- Personalized marketing: AI algorithms used for personalized marketing may raise privacy concerns if they are used to collect and analyze sensitive personal data. It's important to ensure that personal data is collected and used in a transparent and ethically responsible manner, and that individuals are aware of how their data is being used.

- Trading: AI algorithms used for trading may have the potential to significantly affect financial markets. It's important to ensure that these algorithms are transparent and that their impact on markets is understood and managed.

- Financial reporting: AI algorithms used for financial reporting may improve efficiency and accuracy, but it's important to ensure that they are transparent and that any errors or biases are identified and addressed.

In general, it's important to carefully consider the ethical and societal implications of using AI in the banking industry and to ensure that it is used in a responsible and transparent manner. This may involve implementing measures such as bias and error checking, transparency, and accountability."

Ending notes and conclusion

After just three questions, I got the impression that the technology can handle contextual information and hold a dialogue in natural text, in multiple languages and writing styles, while also making self-references and giving preserved structure. Not only the form, but also the content produced had a depth that’s not observed in chatbot solutions so far.

While this new technology improves human-to-computer interaction to great extent, it also brings new challenges that only humans can solve.

One example; when repeating the experiment on another device and session, the chatbot gave similar, but not identical replies, meaning that different answers could be given in a hypothetical customer service interaction. So how can we ensure that the same level of information is shared in all sessions?

Another example; in the second experiment I further explored the concept of AI, credit risk evaluation and ethics further and to my surprise the chatbot reply had a strong political argument opposing dominant class versus minorities, how to ensure content is moderated and sensitive subjects are left out of the dialog?

As software, ChatGPT is currently distributed in preview technology in the form of a SaaS solution. The official website has no undisclosed information about commercial offers at the time of this writing.

As a closing note I have made a last request to ChatGPT:

Me: “Please write an optimistic conclusion, with few words, in Dutch and in Latin."

ChatGPT: Sure! Here is an optimistic conclusion in Dutch:

"AI kan een waardevolle bijdrage leveren aan de bankensector door taken te automatiseren, efficiëntie te verbeteren en de workload te verminderen. Het is belangrijk om de ethische en maatschappelijke implicaties van AI in de bankensector te overwegen en ervoor te zorgen dat het op een verantwoorde en transparante manier wordt gebruikt."

And here is an optimistic conclusion in Latin:

"AI potest valde prodesse sectori bancario per automationem operum, meliorem efficientiam, et minorem onus laboris. Oportet considerare implicationes ethicas et sociales AI in sectori bancario et providere ut eo modo recto et aperto utatur."

While AI technologies such as ChatGPT offer great functionality and therefore enormous potential, there are also many implications which require business professionals to look beyond technology and project the impact on people's lives. How will ChatGPT impact the banking business? Only time will tell.